At a Glance:

- ESG ratings indicate how well a company manages sustainability risks and opportunities—like climate impacts, regulatory changes, and governance issues—that may not be reflected in financial data alone.

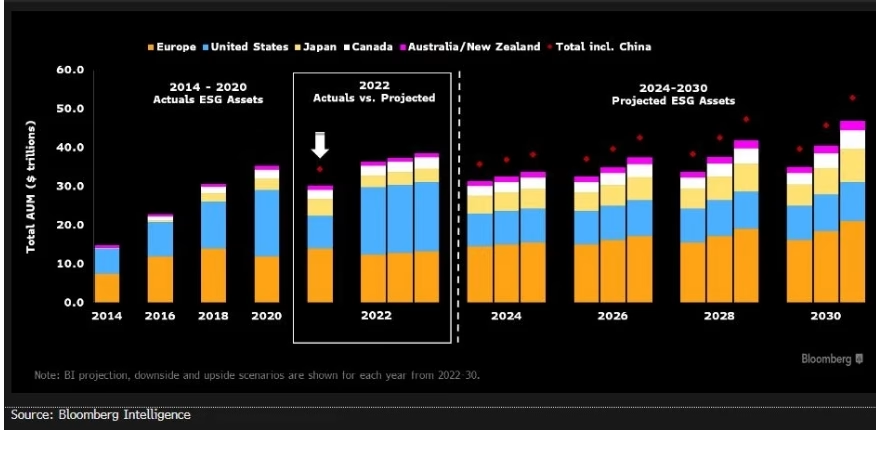

- According to Bloomberg, investors are actively seeking investment opportunities in companies with strong ESG ratings, as evidenced by the projected global growth of ESG-oriented Assets Under Management (AUM) to US$40 trillion by 2030.

- Strong ESG performers demonstrate resilience in volatile markets, outperform peers by more effectively managing risks, respond more readily to market changes, and position companies for long-term financial success.

The article outlines some suggestions for how companies can build further understanding in this complex landscape.

Historically, financial metrics were the sole metric of success, but that is no longer the case today. This shift reflects a deeper understanding that long-term value creation is intrinsically linked with sustainable and ethical practices.

In 2022, global ESG assets surpassed US$30 trillion. Projections indicate that ESG assets are poised to exceed US$40 trillion by 2030. According to Bloomberg, this growth trajectory suggests that in 2030, ESG assets will constitute 25% of the projected US$140 trillion in global assets under management (AUM). This rapid expansion of sustainability-focused assets reflects a shift in investor preferences toward companies with strong ESG performance.

ESG ratings are crucial tools for investors navigating the burgeoning sustainability investment landscape. They offer a structured approach to measuring companies’ ESG performance. Typically, sustainability rating agencies assign these ratings to encompass three key components: environmental, social, and governance.

Though ESG ratings offer a valuable framework for investors seeking to integrate sustainability considerations into their decision-making, they must be approached with a critical and nuanced understanding of their limitations.

Due to a lack of standardisation, ESG ratings involve a degree of subjectivity. Different rating agencies use varying methodologies and data sources, resulting in significant discrepancies in assessing a company’s ESG performance.

This lack of consistency can make it challenging to compare ratings from different providers directly or to assess companies across different sectors. For investors, this inherent uncertainty in ESG ratings signals that they should be used as a starting point for further analysis rather than as definitive indicators of a company’s sustainability performance.

How ESG Considerations Override the Limitations of Financial Reports.

The growing emphasis on sustainability in investment practices shows the importance of integrating ESG considerations into financial analysis.

Capturing Emerging Risks

Companies with a high carbon footprint face increasing regulatory scrutiny and potential financial penalties as the world transitions to a low-carbon economy. Investors use ESG ratings to assess companies’ strategies as one tool to mitigate climate-related risks, such as their emission reduction targets and plans and related capital investments to transition to renewable energy sources.

For instance, investors might assess oil and gas companies based on their emission reduction rates and associated capital investment plans, favouring those with more aggressive strategies. Future risks might not be immediately apparent in traditional financial reports, but ESG ratings can give additional insights to investors and lenders.

Enhancing financial metrics with ESG data

While traditional financial metrics may provide a snapshot of a company’s current financial health, they don’t always fully capture the long-term risks and opportunities associated with sustainability factors. Incorporating ESG data allows creditors to assess a company’s overall resilience and adaptability beyond the debt maturity period.

This provides essential insights into whether the company is well-positioned to navigate future challenges and maintain its ability to repay its debt over the long term.

Increased portfolio resilience during crises

During the first quarter of the 2020 COVID-19 downturn, 24 out of 26 ESG index funds outperformed their conventional counterparts. The results were attributed to ESG actions that delivered more business resilience. For instance, companies with well-defined protocols for crisis management, human capital practices, business continuity planning, and financial resilience were better able to mitigate the pandemic’s impact.

Furthermore, by the end of the third quarter of 2020, 45% of ESG-focused funds outperformed their benchmark index. ESG-focused investments not only provided better risk-adjusted returns but also recovered more quickly than their peers.

Boosting equity performance and investor confidence.

Companies with robust ESG practices often benefit from a lower cost of capital. As lenders and investors view them as less risky due to their commitment to sustainability and responsible governance, these firms can secure loans and attract investments at lower and more favourable rates. This reduces financing expenses, improving profitability and enhancing equity performance.

For example, a study on US banking loans revealed that borrowers with strong social responsibility practices secured lower interest rates, paying 7 to 18 basis points less in interest than those with weaker performance in this area.

Enhances transparency to reduce information asymmetry

Companies with high debt levels, particularly those with significant environmental risks, often face elevated borrowing costs and restricted credit access. Lenders require a comprehensive understanding of a company’s long-term sustainability before extending credit.

ESG information can mitigate this challenge by giving lenders a holistic view of a company’s risk profile beyond traditional financial metrics. A strong ESG performance can signal a company’s commitment to sustainable practices and robust stakeholder relationships, potentially influencing a lender’s decision to extend credit, even in the face of high debt levels.

Decoding the ESG Rating Puzzle

ESG ratings, though valuable, may differ between agencies due to varying methodologies. This stems from the use of diverse criteria, data sources, and the weighting of ESG factors. This can lead to multiple assessment outcomes, leading to a higher perceived investment risk by investors.

Discrepancies in ESG ratings make it harder to identify truly sustainable companies. To navigate this, investors are turning to ESG consultants for due diligence, gaining expert insights on ESG performance, helping investors understand the nuances of different ratings and identifying potential risks not captured by traditional financial metrics.

At Renoir ESG, our process is designed to shift the focus toward performance-driven ESG metrics, helping create long-term value that goes beyond what financial reports alone can capture.

Find Clarity in a Complex Landscape

By acknowledging the complexities and working collaboratively to address the challenges, regulators are stepping in to address concerns about transparency and reliability in the ESG rating market by drafting rules and frameworks to improve the transparency and reliability of ESG data and how it is produced.

For instance, the EU’s legislative framework mandates that ESG rating providers must obtain authorisation from and be supervised by the European Securities and Markets Authority (ESMA) to operate within the EU. Similarly, the UK regulation aims to clarify the methodologies used by ESG rating agencies, addressing concerns about discrepancies in ratings from different providers.

Leveraging our extensive experience in ESG, we propose the following actions to address the key challenges in the field:

Drive change through regulation and data.

Companies, especially those in emerging markets, may lack the resources or expertise to report their ESG performance comprehensively, leading to data gaps and potential underrepresentation in ESG ratings.

To enforce standardisation and ensure reliable data disclosure, regulatory mandates for ESG reporting, like the EU’s Sustainable Finance Disclosure Regulation (SFDR) and the UK’s Sustainability Disclosure Requirements (SDR), can drive greater transparency and data availability.

Incorporate ESG factors in investment analysis and decision-making process.

It is critical to integrate ESG considerations into the investment analysis and decision-making process. This approach includes a comprehensive ESG assessment, considering the nuances of each ESG pillar and how they interact with the company’s specific industry, business model, and geographical context. For example, climate risk materiality varies across industries. A water-stressed company faces greater climate risks than a water-abundant one, even with similar overall ESG scores. Thus, the discount rate adjustment should reflect a company’s specific climate risks.

Engage multiple rating agencies.

By engaging with multiple ESG rating providers and building their own internal tools, investors can better inform their investment decision-making and ensure they meet the requirements of their Responsible Investment mandates.

Integrate ESG data with traditional financial analysis.

ESG data should not be viewed in isolation but integrated into traditional financial analysis to provide a more holistic view of a company’s financial health and long-term value creation potential. For example, ESG factors could be incorporated into credit risk assessments, valuation models, and investment decision-making processes.

Invest in robust internal controls.

It is key to build governance structures that provide a framework for companies to systematically identify and prioritise those sustainability issues most relevant to their business and stakeholders.

This materiality assessment process ensures that companies focus their efforts on areas where they can have the most significant impact. Leaders who champion sustainability and embed ethical considerations into decision-making processes set the tone for a responsible corporate culture.

RenoirESG has extensive experience in the sustainability arena and helps you navigate the complex ESG landscape to achieve favourable ESG ratings. We have established a dedicated ESG Centre of Excellence, using best-in-class and adaptable tools tailored to your company’s specific needs.

Our methodology allows for opportunity identification across your business and prioritises the delivery of tangible business benefits. We will analyse how your company can most effectively enhance its sustainability practices and implement a practical programme to achieve the desired results.

Is your organisation finding it difficult to excel in its sustainability journey?