At a Glance:

94% of Malaysia’s top PLCs have ESG plans, but 86% of SMEs are unaware of it which implies a significant awareness gap that needs to be addressed to promote broader ESG adoption among Malaysian businesses.

Global awareness of sustainability frameworks, such as the United Nations Sustainable Development Goals (UN SDGs), is influencing business practices worldwide, leading to ESG integration as companies adopt successful strategies by others in more mature ESG markets to stay ahead of the curve.

Organisations can accelerate their ESG transformation by developing clear strategy frameworks, leveraging digital solutions, and building internal capabilities while ensuring ESG initiatives align with business objectives to create sustainable long-term value.

Across the globe, and Malaysia is no exception, the importance of ESG practices has gained significant traction. Recognising its critical role in long-term success and resilience, a recent study found that a staggering 94% of Malaysia’s top 50 public limited companies (PLCs) have already implemented ESG plans.

However, there remains a significant gap between large and smaller companies. An Alliance Bank survey found that an alarming 86% of small and medium enterprises (SMEs) polled are not familiar with ESG concepts. This disparity emphasises the urgent need to bridge this knowledge gap and encourage widespread adoption of ESG among Malaysian companies.

What are the main challenges faced by Malaysian companies in adopting ESG practices?

One of the most prominent challenges is the pervasive lack of awareness and understanding of ESG among Malaysian businesses, particularly SMEs (these represent 97.4% of business establishments in Malaysia). This knowledge gap stems from various factors, including:

Misconceptions that ESG is “complex and costly”:

Many businesses perceive it as a complex, costly endeavour relevant only to large corporations or specific industries. The perception of ESG as a costly endeavour, rather than an investment with potential long-term returns, is widespread, with 60% of non-ESG adopters in the Alliance Bank survey citing high implementation costs as a key deterrent.

Lack of technical and operational know-how:

Puteh Salin et al. (2023) found that Malaysian SMEs face significant challenges in complying with ESG standards due to a lack of technical and operational expertise. SMEs lack the internal expertise to define an ESG strategy, collect ESG data, determine disclosure methods, and engage with stakeholders. Limited access to specialised ESG expertise or sustainability consultants is also a barrier. The lack of an ESG guide to champion the ESG journey often leads to delayed implementation, leaving ESG as a buzzword in board meetings.

ESG roadmap uncertainty:

SMEs often find the ESG landscape difficult to navigate due to the lack of standardised criteria, an acceptable ESG standard, and clear guidelines. This is compounded by the fact that ESG reporting frameworks and standards are constantly evolving. Further complicating matters is the lack of clarity within organisations regarding their ESG roadmap. However, in December 2024, Bursa Malaysia introduced frameworks to manage this uncertainty surrounding ESG adoption, but the journey is still in its early stages

Inadequate support mechanisms:

While some support programs exist, such as green financing initiatives, capacity building programs, and government incentives, SMEs often find them insufficient, poorly communicated, or difficult to access. Often family-owned businesses, SMEs have a smaller stakeholder base compared to large corporations. This reduces the immediate pressure to comply with stringent ESG standards.

Insufficient awareness of ESG impacts and benefits:

Many SMEs view ESG primarily as CSR, overlooking its potential to enhance long-term growth and competitiveness. While large corporations and governments prioritise ESG in their supply chains, SMEs remain uncertain about its impact on contract wins. Faced with immediate survival concerns like profit growth (36%), cash flow (35%), and sales planning (32%), as revealed in the 2023 Alliance Bank survey of 610 Malaysian SMEs, ESG implementation ranked a distant fifth priority at only 5%.

How ESG integration can address ESG risks and drive resilience.

Early adoption enables businesses to adapt to the evolving landscape, attract investment, and build resilience, ensuring they are well-positioned for success in a future where sustainability is paramount.

The importance of a structured approach to ESG integration, starts with identifying and prioritising material ESG issues that includes:

- Materiality Assessments: Seeking ESG experts to guide companies in conducting comprehensive materiality assessments to determine the most significant ESG factors for their business and stakeholders. This involves analysing industry trends, regulatory requirements, investor expectations, and stakeholder concerns.

- Sector-Specific Considerations: It is crucial to recognise that different industries face unique ESG risks. For instance, while environmental issues like carbon emissions might be paramount for manufacturing and logistics companies, social aspects like labour practices and community engagement are particularly important for SMEs in Malaysia.

Companies can then move on to develop and implement targeted strategies to address such as:

Initiating their ESG journey by focusing on easy-to-implement measures like energy conservation, waste reduction, and employee engagement.

This initial step builds momentum and demonstrates commitment without requiring significant upfront investments.

Establishing robust governance practices, including transparent reporting, ethical behaviour and board diversity, is vital to mitigate reputational and operational risk.

This is especially critical because in Malaysia, the Securities Commission Malaysia (SC) and Bursa Malaysia play key roles in regulating ESG:

- Securities Commission Malaysia (SC): Sets ESG guidelines for public listed companies (PLCs), promotes sustainability reporting standards and aligns with Securities Commission guidelines.

- Bursa Malaysia: Implements the Sustainability Framework and aligns with Securities Commission guidelines for consistent ESG practices.

ESG Integration and Compliance: How Renoir Can Help.

Our experts at Renoir Consulting support companies at all stages of their sustainability journey in developing and implementing effective ESG strategies.

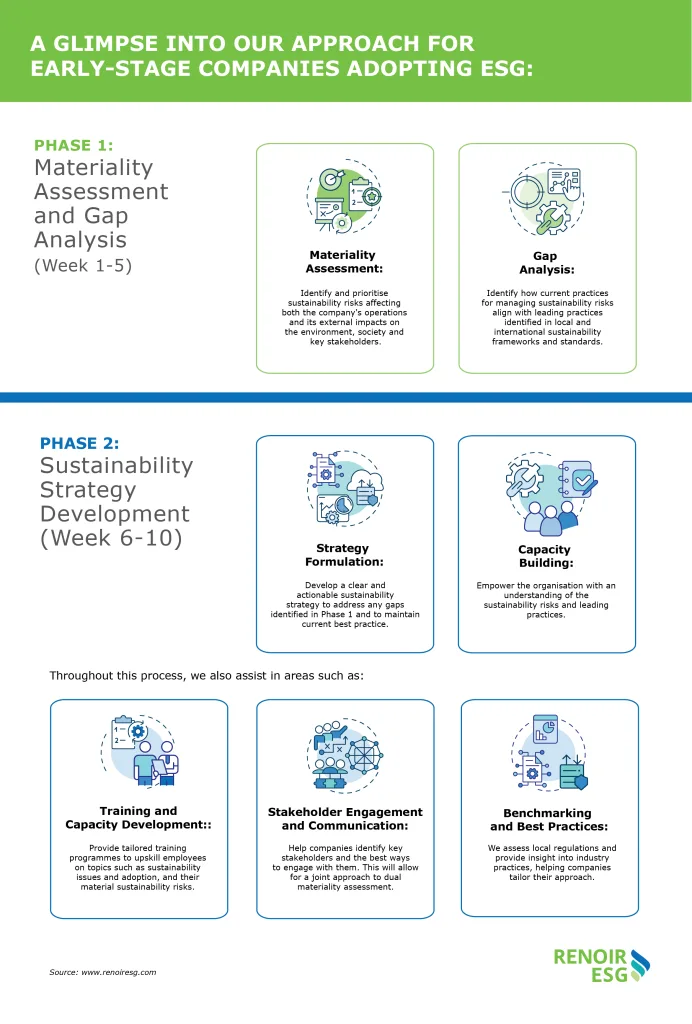

While our ESG strategy framework is built on a 10-week foundation, we recognise that every organisation is unique. Our approach flexes to match your business scale, resources, and readiness—ensuring sustainable adoption whether you’re just starting or enhancing existing initiatives. Success metrics and timelines are tailored to your specific organizational context and capabilities.

Connect with our ESG experts to assess your organisation's readiness and opportunities.