At a Glance

Indirect emissions, particularly Scope 3, represent a significant business risk for many sectors. In many industries, Scope 3 emissions can exceed direct emissions by over six times, exposing firms to greater regulatory, reputational, and transition risks.

This article explains what indirect emissions mean, and why they matter now more than ever.

Indirect emissions, commonly referred to as Scope 2 and 3 emissions, are increasingly recognised as a significant business risk. Accounting for a substantial portion of a company’s total carbon footprint, these emissions are under heightened scrutiny due to mounting demands for transparency from investors, customers, and communities, as well as the escalating financial and reputational impacts associated with climate risk. Scope 3 typically represent the largest source of a company’s emissions, often exceeding 70% of the total carbon output.

For service providers such as lawyers, accountants, and consultants, a significant portion of their carbon footprint is associated with electricity use. For instance, for ERM (a consulting firm), 60% of their footprint is linked to electricity emissions. This primarily falls under Scope 3, particularly within Category 1 (Purchased Goods and Services), and demonstrates how indirect emissions can dominate the overall footprint even in less carbon-intensive direct operations.

As most companies’ carbon impact lies beyond their operational boundaries, what does meaningful accountability look like when the greatest risks exist in areas where traditional management control is limited?

To understand why these emissions matter, we first need to clarify what they are.

What are “Indirect Emissions”?

Both Scope 2 and Scope 3 are categories of indirect emissions. The key distinction is that Scope 2 specifically pertains to indirect emissions from purchased energy, while Scope 3 covers all other indirect emissions across the value chain:

Scope 2 (indirect emissions from purchased energy):

Emissions occur at the energy provider’s facility, but the reporting company is responsible for emissions caused via its energy consumption.

Scope 3 emissions:

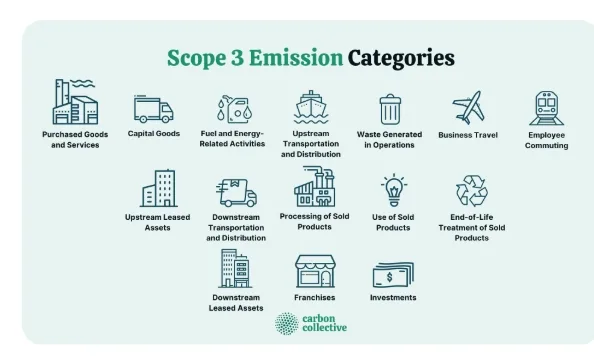

Refer to all other indirect emissions in a company’s value chain. This can include suppliers, customers, employees, waste disposal, transportation, distribution, and leased assets. These emissions are typically the largest source of a company’s total emissions, often exceeding 70%.

Why Scope 3 emissions are harder to measure than direct ones?

Lack of Direct Control

Scope 3 emissions occur across a company’s entire value chain, both upstream (e.g., from suppliers’ activities) and downstream (e.g., from product use by customers). This lack of direct control often means that suppliers may be unable or unwilling to provide emissions information, creating bottlenecks in the reporting process. Concerns regarding intellectual property and data privacy can also prevent suppliers from sharing detailed data.

Pervasive Data Challenges

Data availability and quality are the chief hurdles for Scope 3 reporting. According to a 2025 study by Sphera (collecting responses from 315 sustainability professionals across a broad spectrum of industries), companies also struggle with internal data quality issues (62%), internal data availability (57%), and the sheer calculation complexity (37%) involved in Scope 3. Also, due to the complexity of Scope 3 categories, downstream categories remain consistently underreported due to methodological challenges and data scarcity.

Regulatory and External Environment

A shifting and uncertain regulatory landscape creates confusion and increased compliance burdens, particularly for multinational corporations. Different requirements across jurisdictions (e.g., EU’s CSRD and CBAM) make it hard to prioritise data sources.

Concerns around “Double Counting”

Including Scope 3 emissions in portfolio carbon footprints can lead to double counting. For instance, if an oil and gas company supply all its fuel to a mining firm that uses it exclusively, the oil company’s downstream Scope 3 emissions mirror the miner’s Scope 1 emissions. If both firms are in the same portfolio, those emissions could be counted twice, inflating the portfolio’s total footprint.

Why is Scope 3 reporting becoming increasingly important for businesses?

Despite the numerous challenges companies face in reporting Scope 3 emissions, leaders must pay attention to them for a variety of compelling reasons, extending far beyond mere regulatory compliance:

Stakeholder Demands:

There’s an increasing demand for transparency from various stakeholders. From the same survey study by Sphera, nearly half of the companies surveyed indicate that customers and other stakeholders are requesting emissions data, and 30% are asked to set emissions-reduction targets. Investors are particularly focused on mitigating climate risks and supporting the transition to net-zero, and Scope 3 data provides crucial insights into a company’s value chain risks.

Regulatory Pressure:

While some regulatory timelines have been adjusted, global regulations are still progressing. Examples include the EU’s CSRD, and the proposed standardisation of climate-related disclosures by the US SEC. These regulations will increasingly mandate comprehensive GHG reporting, including Scope 3.

Risk Management:

Understanding scope 3 emissions help companies spot potential risks to the climate transition. For example, new laws in the EU (CSRD, CSDDD) and California (SB 253) aim to enforce tracking, publication and reduction of these emissions. The EU’s CSRD, for instance, forces companies to disclose scope 3 emissions alongside financial disclosures. Penalties for non-compliance may include a fine as high as 5% of turnover.

Competitive Advantage and Reputation:

Addressing Scope 3 emissions enhances a company’s reputation, appeals to eco-conscious customers, and can build market share. Getting ahead of sustainability efforts can also provide a competitive edge.

Supply Chain Resilience:

Because Scope 3 emissions come from suppliers and other value chain partners, companies are exposed to risks if their suppliers face regulatory penalties, increased costs, or operational disruptions related to carbon emissions. This can lead to supply chain interruptions, higher prices, or the need to find new suppliers, directly affecting business continuity and profitability.

So how can companies respond effectively to these challenges?

This is where expert support becomes crucial. From closing data gaps to engaging suppliers and aligning with shifting regulatory standards, companies need tailored strategies and hands-on guidance.

Renoir ESG supports businesses with robust Scope 3 estimation and assessment models, which can help fill in the gaps in companies’ carbon-emission reporting, and this initiative can be carried out while avoiding the common pitfalls when applied across a portfolio. Our experts also help develop strategic, two-way partnerships with suppliers, fostering collaboration for co-development of reduction targets, cooperative support, and alignment on reporting standards.

Scope 3 rules are forcing companies to finally look at the full picture. Not just their own emissions, but everything tied to what they buy, make, and sell. Not easy, but it’s overdue.

Looking to enhance your company's Scope 3 emissions tracking and drive meaningful decarbonisation?