At a Glance:

Artificial intelligence (AI) is transforming the way businesses approach sustainability, making Environmental, Social and Governance (ESG) strategies more efficient, accurate and insightful.

This article explores how AI is changing how organisation can analyse ESG data, automating collection and improving reporting to unlock deeper insights and ensure compliance.

The global AI in ESG & Sustainability Market was valued at US$ 182.34 billion in 2024. It is projected to experience substantial growth, reaching an estimated US$ 846.75 billion by 2032, according to this report. This data reflects the increasing recognition that AI is a key enabler of efficient and forward-looking ESG data management.

Traditional ESG data management and reporting methods are often manual and fragmented, which means they are no longer sufficient to meet increasing demands for transparency, consistency, and real-time accountability.

Companies face significant challenges, including:

- A lack of standardised reporting across industries.

- Different frameworks and formats, making comparisons difficult and undermining data reliability.

- Fragmented data, stored in disconnected spreadsheets or systems. This makes consolidation time-consuming and prone to errors.

- Growing regulatory complexity, with mandates like the EU’s CSRD and ISSB frameworks.

- Many existing tools are not built to handle this complexity.

Artificial Intelligence (AI) emerges as a transformative force that directly addresses these shortcomings. AI revolutionises corporate approaches to sustainability practices by streamlining the intricate, data-centric procedure of ESG strategy formulation, objective establishment, implementation, and reporting.

But how exactly does AI reshape ESG strategy, empower real-time decision-making, and unlock new opportunities for businesses striving to lead in sustainability?

Foundational Role of ESG Data

ESG reporting, also known as sustainability reporting, involves publishing an organisation’s non-financial performance, including its impacts and actions related to climate change, human rights, and diversity, equity, and inclusion (DEI). It is used by management to influence perceptions and relationships with stakeholders, such as investors, employees, customers, and regulators, and can also lead to improved management practices. Companies manage vast volumes of ESG data, from energy usage and emissions to workforce diversity and supply chain practices.

What Role Does ESG Data Play in Sustainability Strategy?

AI is rapidly becoming a cornerstone for sustainability by automating, streamlining, and enhancing ESG data management and reporting enables ESG teams to capitalise on extensive opportunities through analysis of large datasets, identification of performance risks, and more.

AI’s role in leveraging ESG data for sustainability strategy includes:

◦ Enhanced Accuracy and Efficiency:

Businesses utilising AI for ESG data management have reported up to a 40% reduction in data processing time and a 30% gain in reporting accuracy AI-powered tools are designed to streamline the collection of ESG data from various disparate sources. These sources are extensive and can include internal systems, Enterprise Resource Planning (ERP) tools, existing sustainability reporting tools, supplier databases, regulatory filings, third-party databases, public disclosures, news articles, press releases, conference call transcripts, and even social media. For example, Microsoft leverages AI and machine learning to monitor and forecast carbon emissions, supporting its ambitious goal to become carbon negative by 2030. This approach allows for more accurate, real-time sustainability insights, enhancing operational decisions and reporting quality.

◦ Deeper, Actionable Insights:

Generative AI (Gen-AI) empowers ESG teams to capitalise on extensive opportunities by analysing large datasets, model various sustainability scenarios, forecast potential outcomes, and make data-driven decisions faster. By integrating IoT devices and live data feeds, AI empowers your business with real-time dashboards that monitor critical ESG metrics, like emissions, water consumption, labour practices, and regulatory compliance. This real-time visibility enables you to stay ahead of hidden anomalies, risks and compliance issues while identifying opportunities to improve efficiency and impact.

◦ Cost Reduction:

AI contributes to cost savings by optimising energy consumption and logistics. For instance, AI-driven predictive analytics can assist organisations in determining the most sustainable delivery routes, substantially reducing greenhouse gas emissions and associated costs. Real-time monitoring of energy consumption enabled by AI also leads to significant energy savings. AI minimises tasks that are intensive in terms of resources, allowing organisations to scale reporting processes more efficiently. This also contributes to lowering resource costs.

◦ Improved Transparency and Stakeholder Trust:

Unilever has adopted blockchain technology to enhance supply chain transparency, validate sustainability claims, and build greater trust among stakeholders. In parallel, AI and machine learning models play a pivotal role in improving ESG data reliability. These technologies can detect anomalies, flag inconsistencies, and identify missing values—significantly reducing human error and minimizing the risk of inaccurate or incomplete reporting.

This improved accuracy directly enhances the credibility and integrity of ESG disclosures. Furthermore, AI enables continuous monitoring of ESG performance, ensuring stakeholders have access to real-time, dynamic insights rather than static, retrospective data.

RenoirESG Advisory for AI-Driven Sustainability

The question isn’t whether your business should use AI in ESG—it’s how soon you can start.

At RenoirESG, our experts work alongside your teams to explore how artificial intelligence can enhance your ESG data strategy and drive real business value.

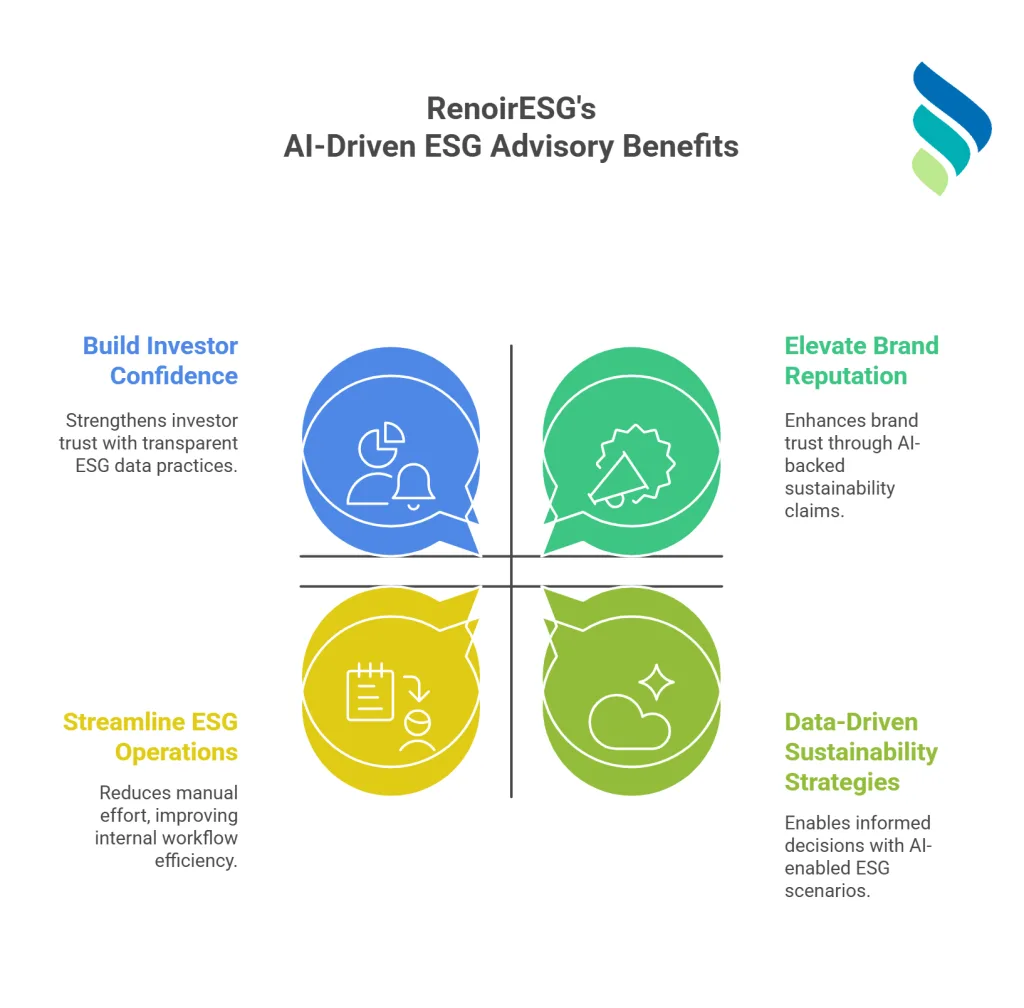

The diagram below depicts RenoirESG’s advisory services of integrating Ai in ESG strategies.

Here’s how RENOIR ESG OPERATE WHENYOU ENGAGE WIT US:

Streamline ESG Operations

We assess where AI can reduce manual effort in your reporting processes, saving time and resources while improving data quality and workflow efficiency.

Build Investor Confidence

By guiding you toward more consistent, transparent ESG data practices, supported by AI where appropriate, we help you meet stakeholder expectations and strengthen valuation narratives.

Elevate Brand Reputation

We support you in using AI-driven insights to back up your sustainability claims with credible, real-time data—reinforcing trust among consumers, partners, and regulators.

Data-Driven Sustainability Strategies

Our team helps you model AI-enabled ESG scenarios that allow for faster, more informed decision-making in a rapidly evolving regulatory and market landscape.

Not sure how to embed success-guaranteed ESG data management?